Do Most Millionaires Get Rich from Real Estate?

Jan, 30 2026

Wealth Path Calculator

Important: This calculator shows real data from the 2024 Wealth Report. Only 12% of millionaires built wealth primarily through real estate—most used businesses, stocks, or high-income careers.

Your Financial Inputs

Wealth Building Paths

Wealth Comparison

| Path | Time to $1M | Key Factors |

|---|---|---|

| Business/Entrepreneurship | -- |

Based on 2024 data: 42% of millionaires built wealth through business Requires startup capital, risk tolerance, and long-term commitment |

| Stock Market Investments | -- |

Based on 2024 data: 28% of millionaires grew wealth through stocks Requires consistent investing and patience (20+ years) |

| Real Estate (Rental Properties) | -- |

Based on 2024 data: 12% of millionaires built wealth through real estate Requires upfront capital and ongoing management |

| High-Income Career | -- |

Based on 2024 data: 18% of millionaires came from high-income professions Requires 15+ years of consistent high earnings |

Key Insight: Real estate is rarely the primary path to becoming a millionaire. Most successful real estate investors have other income sources first. It's better as a secondary wealth-building tool.

It’s a story you hear all the time: someone buys a rundown apartment building, fixes it up, rents it out, and ends up a millionaire. It sounds simple. Too simple. So is it true? Do most millionaires get rich from real estate?

The short answer? No. Real estate is a powerful tool for building wealth, but it’s not the main path for most self-made millionaires. A study by Thomas Stanley and William Danko, authors of The Millionaire Next Door, tracked over 1,000 millionaires over 15 years. Only about 20% of them built their wealth primarily through real estate. The rest got there through businesses, stocks, professional careers, and tech startups.

Here’s the twist: real estate often shows up as a secondary source of wealth, not the primary one. Most millionaires who own property didn’t start with it. They built a business first, saved aggressively, and then used their cash flow to buy rental units or commercial buildings. Real estate didn’t make them millionaires-it helped them keep and grow what they already had.

Where Real Estate Actually Fits in Wealth Building

Real estate works best when it’s part of a larger strategy. Think of it like a safety net with upside. It doesn’t usually create massive wealth overnight, but it does create steady, predictable income and tax advantages that compound over decades.

Take the example of a dentist who opens a practice in a growing city. After 10 years, they’ve saved $800,000. Instead of leaving it in a savings account earning 0.5% interest, they buy a small office building with four units. Three units rent out for $2,500/month each. That’s $90,000 a year in gross income. After expenses, taxes, and mortgage, they’re netting $50,000-$60,000 a year, tax-efficiently, with the building appreciating 3-5% annually. Over 20 years, that’s over $1 million in equity and income-on top of their original savings.

That’s not magic. That’s discipline. Real estate rewards patience, not luck. It doesn’t turn a $50,000 salary into $10 million in five years. But it turns a $150,000 annual income into $500,000+ in net worth over time-without needing to sell your business or cash out your stock options.

Why the Myth Persists

Why do so many people believe real estate is the golden ticket? Because it’s visible. You can see a house. You can walk into an apartment building. You can point to a landlord and say, “That guy owns five properties.” But you can’t see a software engineer’s equity in a startup. You can’t see the 12 years of late nights and failed products behind a tech founder’s success.

Media loves the real estate story. TV shows like Flip or Flop and YouTube channels showing “how I bought my first rental at 22” make it look easy. But those are outliers. Most people who try to flip houses end up losing money. According to the National Association of Realtors, nearly 40% of house flippers in 2023 lost money after costs, taxes, and holding fees.

Real estate influencers often cherry-pick success stories. They don’t show you the 17 properties they bought that sat empty for 18 months. They don’t mention the $30,000 in repairs on a tenant-damaged unit. They don’t talk about the 300 hours spent screening applicants or the $12,000 in legal fees from a bad lease.

Who Actually Gets Rich from Real Estate?

There are real paths to wealth through property-but they’re not glamorous. Here’s who succeeds:

- Commercial landlords with long-term leases: A doctor who buys a medical office building and signs a 10-year lease with a clinic. Rent is locked in. No tenant turnover. No repairs on weekends.

- Industrial warehouse owners: With e-commerce booming, warehouses in logistics hubs are in high demand. Rents are rising. Vacancy rates are below 5% in major markets like Atlanta, Dallas, and Riverside.

- Multi-family investors in growing cities: Buying a 12-unit apartment building in Austin or Nashville isn’t about flipping. It’s about collecting rent from 12 families every month, year after year.

- People who inherit property and hold it: A lot of old-money millionaires didn’t build wealth-they inherited land or buildings and let time and inflation do the work.

These aren’t get-rich-quick stories. They’re slow, steady, and require capital, knowledge, and time. The average commercial real estate investor holds a property for 12-15 years before selling. That’s not a side hustle. That’s a career.

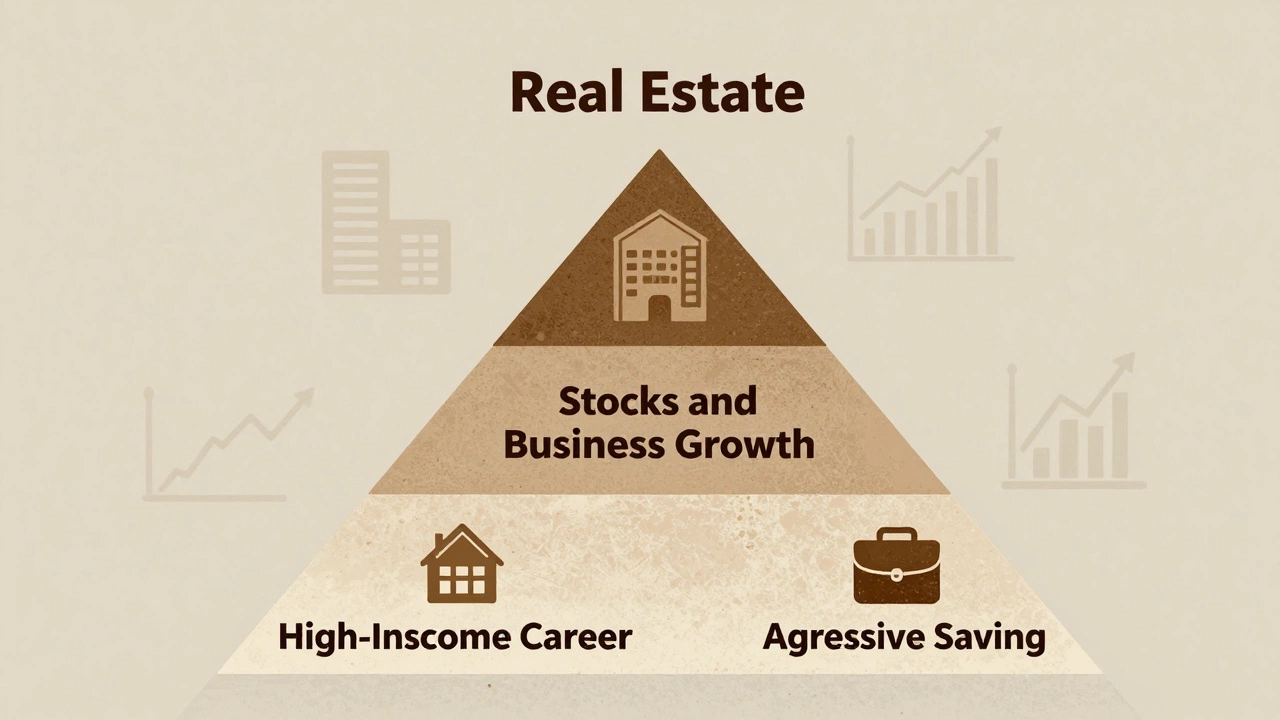

The Real Wealth Builders: What Most Millionaires Actually Did

Let’s look at the real data. The 2024 Wealth Report by Spectrem Group analyzed 10,000 U.S. millionaires. Here’s how they built their net worth:

- 42% built wealth through their own business

- 28% grew wealth through stock market investments (ETFs, individual stocks, retirement accounts)

- 18% came from high-income professions (doctors, lawyers, engineers, executives)

- 12% used real estate as their main path

Notice something? Real estate is last. And even then, many of those 12% had other sources of income first. Only 3% of millionaires in the study started with real estate as their first job or main source of income.

Compare that to the top 100 self-made billionaires in the U.S. according to Forbes: only three built their fortune primarily through real estate. The rest? Tech (Elon Musk, Jeff Bezos), finance (Warren Buffett), retail (Sam Walton), and manufacturing.

Why Real Estate Still Matters for Millionaires

Even if it’s not the main source, real estate is a staple in most millionaire portfolios. Why?

- It’s a hedge against inflation: Rent increases with inflation. Property values rise. Cash flow grows over time.

- It’s a tangible asset: Unlike stocks that vanish in a market crash, you can still live in or rent out a building.

- It offers tax breaks: Depreciation, mortgage interest deductions, 1031 exchanges-these aren’t loopholes. They’re legal tools that let you keep more of your income.

- It diversifies risk: If the stock market crashes, your rental income doesn’t disappear.

Most millionaires don’t have 100% of their net worth in real estate. They have 15-30%. That’s enough to stabilize their portfolio, not define it.

Can You Get Rich from Real Estate? Yes-but Not the Way You Think

You can absolutely build wealth through real estate. But it’s not about buying one house and selling it for a quick profit. It’s not about using someone else’s money to flip condos in Miami.

It’s about:

- Building a high-income career or business first

- Living below your means and saving 20-30% of your income

- Buying rental property in a growing market-not a trendy one

- Holding it for 10+ years

- Reinvesting cash flow into more properties

One nurse in Ohio bought a duplex in 2008 for $95,000. She lived in one unit, rented the other. Over 15 years, she paid off the mortgage, raised rent from $800 to $1,800/month, and bought two more duplexes. Today, she owns four properties, collects $7,200/month in rent, and has $1.4 million in equity. She’s not a billionaire. But she’s financially free-and she never worked in finance or started a company.

That’s real. That’s possible. But it’s not the norm. It’s the exception built on consistency, not luck.

Final Thought: Real Estate Isn’t the Shortcut. It’s the Anchor.

If you’re hoping to get rich from real estate, you’re setting yourself up for disappointment. The market doesn’t reward dreamers. It rewards planners.

Real estate doesn’t make you rich. But if you’re already on the path to wealth-through a job, a business, or smart investing-it can lock in your success. It turns income into assets. It turns effort into equity. And over time, that’s how fortunes are really made.

Don’t chase the myth. Chase the method. Build your income. Save your money. Then, and only then, buy property. That’s how the real millionaires do it.