Can You Buy a House Over the Internet? Here's How It Actually Works in 2026

Feb, 17 2026

Mortgage Calculator for Remote Home Buying

Estimate Your Monthly Payments

Your Estimated Monthly Payment

Monthly Payment

$0

Principal & Interest

Total Interest

$0

Over the loan term

Total Paid

$0

Principal + Interest

Note: This estimate does not include taxes, insurance, or PMI. For remote home purchases, you'll need to factor in these costs when discussing with your lender.

It used to be that buying a house meant weeks of open houses, handshakes with agents, stacks of paper, and driving across town just to see if a basement leaks. But now? You can browse dozens of homes in pajamas, sign closing documents on your phone, and get the keys without ever stepping foot inside. Buy house online isn’t a gimmick anymore-it’s real, legal, and happening every day across the U.S.

Yes, You Can Buy a House Without Setting Foot Inside

In 2026, buying a home remotely is not just possible-it’s common. States like California, Texas, Florida, and Arizona have fully integrated digital closings into their real estate systems. You can start your search on Zillow or Redfin, schedule a live video walkthrough with a local agent, get a virtual inspection via drone and 3D scanning, and sign all your paperwork electronically using e-sign platforms like DocuSign or NotaryCam. The entire process, from offer to keys, can be done in under 30 days.

How? Because of three big shifts: digital title companies, remote online notarization (RON), and blockchain-backed deed transfers. In California, RON became law in 2020. Since then, over 1.2 million property transactions have been completed without a single in-person meeting. That’s not theory. That’s data from the California Department of Real Estate.

What You Need to Buy a House Online

It’s not magic. It’s logistics. Here’s what you actually need to close a deal without ever visiting the property:

- A pre-approved mortgage - Lenders like Rocket Mortgage and SoFi let you get pre-approved in under 10 minutes online. You’ll need your income docs, credit score, and bank statements ready.

- A licensed local real estate agent - Even if you’re buying remotely, you still need someone on the ground. They’ll handle showings, negotiate offers, and coordinate inspections. Look for agents who specialize in remote buyers-many now list it as a service.

- A virtual inspection - Companies like Inspectorio and HomeGauge offer drone-assisted inspections. They’ll film every room, test HVAC, check for mold, and send you a full report with thermal imaging. Some even include a 3D tour you can walk through on your tablet.

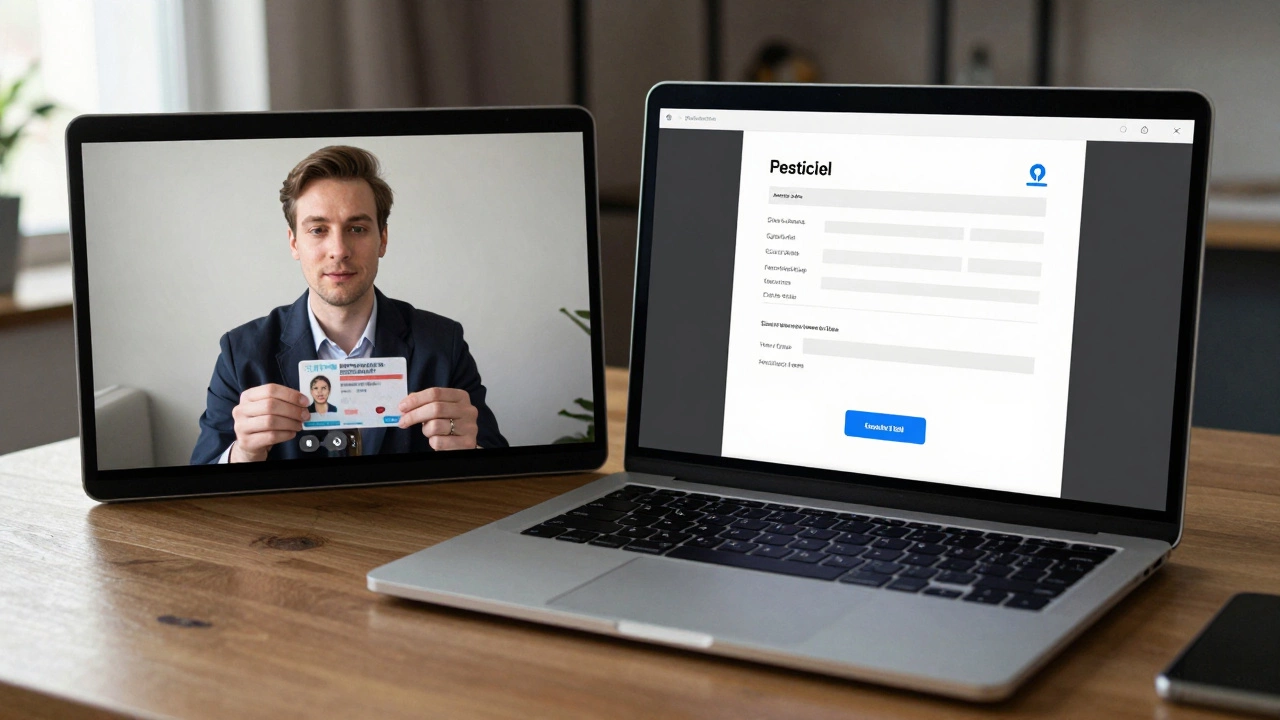

- An e-closing platform - Your title company will send you a secure link to sign deeds, disclosures, and loan papers. You’ll verify your identity with facial recognition and a government ID scan.

- A remote notary - All 48 states now allow RON. You’ll meet a notary on Zoom, show your ID, and sign in real time. The notary uploads everything to a state-approved registry.

That’s it. No need for a second trip. No waiting for notary hours. No printing 87 pages.

How It Works: A Real Example

Take Sarah, a software engineer in Seattle. She wanted to move to Phoenix for a remote job. She found a 2021-built single-family home on Redfin for $420,000. She clicked "Request Virtual Tour" and got a 15-minute live walkthrough with the listing agent. The agent pointed out the new roof, the smart thermostat, and the leak-free gutters.

Sarah hired a local inspector who sent her a 40-page report with photos and videos. She reviewed it, asked questions via chat, and approved the inspection. Her lender sent her the loan estimate the same day. She signed the purchase agreement using DocuSign. Two days later, she did her remote notarization on her laptop at 11 p.m. while eating takeout.

On closing day, she got a text: "Your keys are in the lockbox. The code is 1234." She drove down from Seattle a week later to move in. No paperwork. No meetings. No stress.

What You Can’t Do Online (And Why)

Not everything is digital. Some things still need you there.

- Final walk-through - Most lenders require a final inspection before closing. You can do this via live video with your agent, but you’ll need to confirm everything matches the contract.

- Homeowners insurance - You can buy it online, but some insurers still require a photo of the front door or a roof inspection. It’s automated now, but not fully AI-run.

- Property taxes - You’ll get notices by mail or email, but you still need to pay them. Most counties let you pay online, but you’ll need to register your account with your property ID.

- HOA rules - If the home is in a community with rules about fences, pets, or rentals, you’ll need to read them carefully. Some HOAs still require signed paper forms.

These aren’t deal-breakers. They’re just checkpoints. You’re not buying blind-you’re buying smarter.

Who’s Doing This? Real Numbers

In 2025, 38% of all home purchases in California were completed remotely. That’s up from 12% in 2020. Florida saw 41% of out-of-state buyers complete transactions without visiting. The National Association of Realtors says 63% of buyers under 35 prefer to start their search online-and 44% of them completed the entire process without a single in-person visit.

Why? Because millennials and Gen Z don’t want to waste time. They’re used to ordering groceries, booking flights, and filing taxes online. Why should buying a house be different?

Even retirees are jumping in. A 2025 survey by AARP found that 29% of seniors who moved in the last year bought their new home entirely online. They used video tours, trusted agents, and e-signatures to avoid the stress of traveling long distances.

Risks? Yes. But They’re Manageable

Is buying a house online risky? Sure. But so is buying a car without a test drive. The key is knowing what to watch for.

- Bad agents - Some agents push remote buyers toward overpriced homes because they’re not there to see the flaws. Always check reviews. Look for agents with "remote buyer specialist" in their bio.

- Inspection gaps - Drones can’t see behind walls. Make sure your inspector is licensed and includes a full structural scan. Ask for thermal imaging.

- Scams - Fake listings are still out there. Always verify the property through the county assessor’s website. If the listing doesn’t match the official tax records, walk away.

- Legal differences - Each state has different rules for e-signatures and notarization. California and Texas are fully ready. Some rural counties in Mississippi or West Virginia still require in-person closings.

Do your homework. Use trusted platforms. Stick to licensed professionals. You’ll be fine.

Where to Start

If you’re thinking about buying a house online, here’s your 5-step starter plan:

- Get pre-approved for a mortgage using Rocket Mortgage, SoFi, or Quicken Loans.

- Search on Redfin, Zillow, or Realtor.com. Filter for homes with "virtual tour" or "remote buyer friendly."

- Hire a local agent who specializes in remote buyers. Ask if they’ve handled 10+ remote closings in the last year.

- Request a drone inspection and 3D walkthrough. Review it with your inspector.

- Confirm your state allows remote online notarization. If yes, you’re ready to go.

It’s not complicated. It’s just different.

What Comes Next

The next leap? AI-powered home matching. Companies like Opendoor and Offerpad already use algorithms to suggest homes based on your commute, school ratings, and even noise levels. In 2026, you’ll be able to input your priorities-"I want a quiet street, 2 bedrooms, under $500K, near a park"-and get a ranked list of 5 homes with video tours, tax history, and resale projections.

Soon, you won’t even need an agent. AI will guide you, verify documents, and flag risks. But for now? You still need a human to hold your hand through the closing. And that’s okay.

Buying a house online isn’t about replacing people. It’s about removing the friction. The paperwork. The waiting. The driving. You’re not losing control-you’re gaining time.